“[China is] worried about forever-rising deficits, which may devalue Treasuries by pushing interest rates higher… Inside China there has been a lot of debate about whether they should continue to buy Treasuries.”—JP Morgan economist Frank Gong, “China 'worried' about US Treasury holdings.”

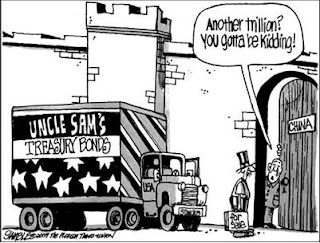

“[China is] worried about forever-rising deficits, which may devalue Treasuries by pushing interest rates higher… Inside China there has been a lot of debate about whether they should continue to buy Treasuries.”—JP Morgan economist Frank Gong, “China 'worried' about US Treasury holdings.”Robert Romano reports: China is worried about the value of nearly half of its $2 trillion in currency reserves that include U.S. Treasury bonds and other notes issued by the U.S. As well they should be. They are only as good as America's promise to pay them back.

It's a simple principle: The more money one borrows to fuel an out-of-control, unbridled spending spree, the more resources must be dedicated to paying back that debt with interest. If too much debt is incurred, it eventually becomes impossible for the debtor to ever emerge solvent.

And if there was any doubt that the Chinese are indeed worried, one need look no further than recent comments by the Chinese premier, Wen Jiabao, who said, “We have a huge amount of loans to the United States. Of course we are concerned about the safety of our assets. To be honest, I'm a little bit worried… I would like to call on the United States to honor its words, stay a credible nation and ensure the safety of Chinese assets.”

Eventually, Congress, the Treasury, and the Fed's seemingly endless supply of money from overseas will come to a halt. The nation's creditors can no more afford to continue lending the money on this scale as we can continue to borrowing it. Eventually there comes a tipping point where the debtor is so far underwater, that he or she drowns—and all who would have once thrown a life-preserver are treading water themselves. At that point, a global run on the dollar would ensue as the debts are called in one after another, leaving the American taxpayer with an insurmountable bill. . . . [Read: Getting Out While the Getting's Good? for the solution.]

Eventually, Congress, the Treasury, and the Fed's seemingly endless supply of money from overseas will come to a halt. The nation's creditors can no more afford to continue lending the money on this scale as we can continue to borrowing it. Eventually there comes a tipping point where the debtor is so far underwater, that he or she drowns—and all who would have once thrown a life-preserver are treading water themselves. At that point, a global run on the dollar would ensue as the debts are called in one after another, leaving the American taxpayer with an insurmountable bill. . . . [Read: Getting Out While the Getting's Good? for the solution.]Tags: ALG, bailout, Borrowing, China, credit, deficit, Economics, Robert Romano, Stop the Bailout, U.S. Treasury, United States To share or post to your site, click on "Post Link". Please mention / link to the ARRA News Service. Thanks!

0 comments:

Post a Comment